In the multipolar world, the struggle for power remains. However, the problem occurs when people close borders and work against the spirit of globalization.

The World Bank’s June 2019 Global Economic Prospects (GEP) report titled, ‘Heightened Tensions, Subdued Investment’ says the global economy “has continued to soften and momentum remains weak” and investment, sluggish.

The report certainly does not bring good news for the world economy collectively. However, there are some countries like India will have a constant growth of 7.5% per annum in 2019, 2020 and 2021.

Get Seeker's Magazine for Rs 85 Per Month Only- Visit Store

What are the reasons for the slow growth of the world?

According to the World Bank’s report, the slow growth will be due to rising in trade barriers, a build-up government debt, and deeper slowdowns in economies.

One among the prominent reasons for the slowdown is the US-China Trade conflict, which jeopardizes the spirit of open borders for trade. The situation further remains unsolved and even may worsen.

While some countries could benefit from trade diversion in the short run, adverse effects from weakening growth and rising policy uncertainties involving the world’s two largest economies would have predominantly negative repercussions.

The Brexit also will cause certainly a low in Eurozone. This all remains connected with global growth.

There are two options for Britain, in case of Brexit, the financial stability will be hurt, and in case of ‘no-deal Brexit’- there will be a severe impact on the U.K. There will be lower European Trade and disruptions and delays will occur on the border.

The United Kingdom accounts for a large share of cross-border lending to some EMDEs, which could be negatively impacted by a sudden retrenchment.

The investments in Emerging Markets Developing Economies (EMDEs) remain low, and due to weaker global growth, it has limited the potential for public investment. The debt levels are going up, and that further constrains the investments.

Even, advanced economies like the United States and Europe will see weaker investments and export. Even though the Euro Area has a monetary policy supporting the economy yet, softness in trade and domestic demand is expected.

U.S. policy uncertainty is expected to significantly erode growth and investment across EMDEs, as protectionist measures impact a wide range of downstream industries and trading partners due to the existence of global value chains.

Some fact’s related to the world’s growth

Advanced economies as a group are expected to slow down in 2019, particularly the Euro Area, due to weaker investments and exports.

U.S. growth is expected to slow to 2.5% this year, down from an estimated 2.9% in 2018, and then down to 1.7% and 1.6% in 2020 and 2021 respectively.

Softness in trade and domestic demand is expected to put Euro Area growth at 1.4% in 2020-21, despite monetary policy support continuing for that economy.

The World Bank Group has downgraded global real GDP growth to 2.6% for 2019, down by 0.3%age points from its previous forecast in January.

Growth is expected to increase marginally to 2.7% in 2020. India’s growth forecasts are projected to be 7.5% per annum in 2019, 2020 and 2021 — not having been downgraded from their January estimates.

A growth rate of 7.2% was estimated for 2018.

What is the importance of Global Trade?

Global Trade enhances economic ties between nations. Open borders for trade help in business activities bring new technologies and product. However, the downside of it remains that it brings a shift in domestic industries which caused the political discomfort.

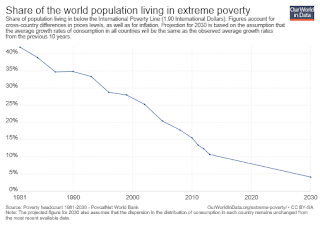

There is no doubt that ‘open borders’ have supported stronger economic growth. Due to stronger economic growth, poverty has reduced drastically. (See Image-1.1)

|

| Image-1.1 |

The world’s poorest countries face the most daunting challenges due to entrenched poverty, fragility and geographic isolation, and for reducing poverty they need investments.

Stronger economic growth is essential to reducing poverty and improving living standards.

Current economic momentum remains weak, while heightened debt levels and subdued investment growth in developing economies are holding countries back from achieving their potential.

It’s urgent that countries make significant structural reforms that improve the business climate and attract investment. They also need to make debt management and transparency a high priority so that new debt adds to growth and investment.

Unless they can get onto a faster growth trajectory, the goal of lowering extreme poverty under 3% by 2030 will remain unreachable.

The rate of extreme poverty has fallen rapidly: in 2013 it was a third of the 1990 value. The latest global estimate suggests that 11% of the world population, or 783 million people, lived below the extreme poverty threshold in 2013. The global trade reduction will increase in poverty in regions.

Read About

India and South Asia

South Asia’s growth remained “robust” in the face of global economic headwinds and weakening trade and manufacturing, as per the report.

In India, where growth was 7.2% in FY2018/2019, investment — both, private and in public infrastructure - offset a slowdown in government consumption.

Soft agricultural prices dampened rural consumption but urban consumption was bolstered by credit growth.

With regard to production — robust growth was broad-based the report says, with the industrial sector accelerating on the back of manufacturing and construction, and agriculture and services sectors moderating, due to a “subdued harvest” and slowing trade, hotel, communications, and transport sector, respectively.

India’s growth at a projected 7.5% is supported by credit growth and an accommodative monetary policy.

Support from delays in planned fiscal consolidation at the central level should partially offset the effects of political uncertainty around elections.

The continuing weakness in corporate and financial sector balance sheets remain a constraint for growth despite recent improvements in the Ease of Doing Business in India.

Conclusion

If these trade tensions escalate and tariffs go higher, there will be a deeper slowdown in major economies. Not only that, there will be significant spillover through trade channels, and through the commodities market, and it will lead to much lower growth. Therefore, the governments and policymakers should abstain from the practices which hamper the trade between nations, as in the long run - the poverty and hunger will hit the entire globe.

No comments:

Post a Comment